Investing can be an exciting and potentially lucrative venture—if done properly. But so often, people lose money when investing in Nigeria, leaving them feeling confused, frustrated, and out of pocket.

That’s the purpose of this post—to give you the inside scoop on why people lose money when investing in Nigeria. From wrong decisions to missing out on key information and not having enough knowledge of the markets, we’re here to help you avoid making the same mistakes many investors make.

After reading this post, you’ll understand some of the most common missteps that can lead to failure as an investor. You’ll learn how to think logically about your investments and gain a better understanding of the world of investment. Sit still, don’t blink – read on to get all the insights you need!

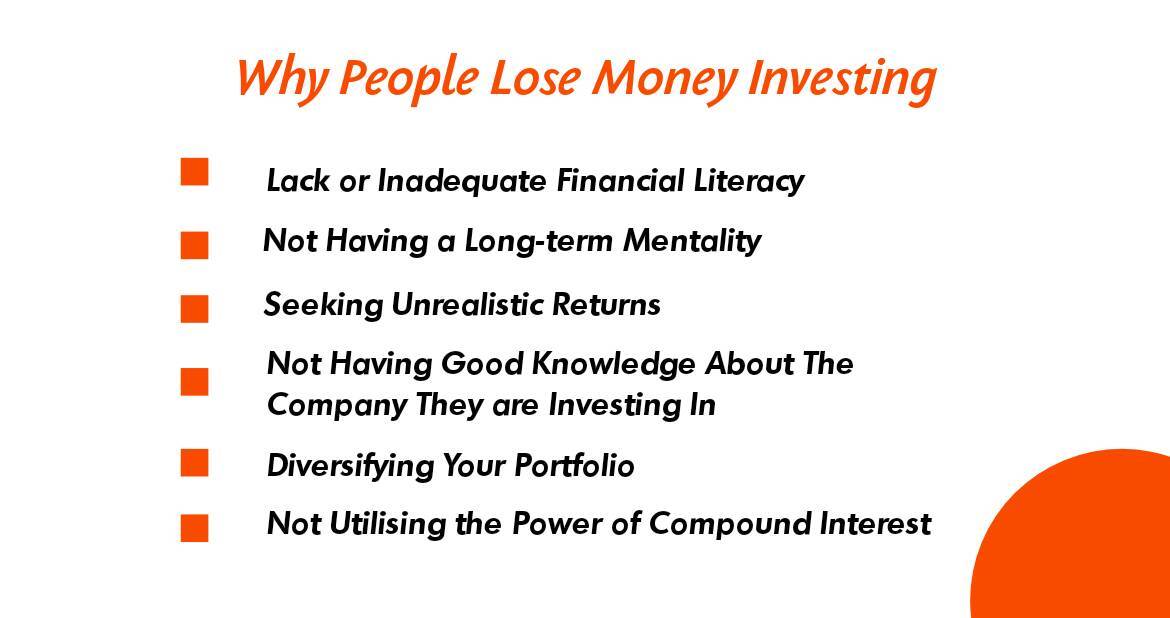

Lack or Inadequate Financial Literacy

If you’re investing in Nigeria, it’s important to have a solid foundation of financial literacy; otherwise, you could end up losing money. Many people fail to properly understand the risks associated with an investment and can therefore find themselves in a vulnerable position.

One major problem is the lack of financial education available, which means many people are unaware of the consequences that come with irresponsible investing. Investing without taking all the relevant factors into account can be like throwing your hard-earned money away—but luckily, there are ways to improve your chances of success when investing.

Simple steps such as researching investments before making them and seeking professional advice will help to ensure that your long-term goals are achievable and help you stay informed about the latest investment trends. Taking precautionary measures will not only safeguard your money but even potentially help you turn a profit.

Not Having a Long-term Mentality

When it comes to investing in Nigeria, having a long-term mentality is essential. Too often, people get caught up in chasing quick returns and end up losing money. It’s important to develop a strategy for the long haul and have realistic expectations – the goal should be to consistently make small wins over time that add up.

An important step is setting realistic goals and understanding the different types of investments available.

It’s also important to understand the markets in Nigeria, so you can anticipate possible sudden changes and adjust your strategy accordingly. Spend some time researching on your investment options – it’s not just about throwing money into something and hoping for the best!

With patience and persistence, having a long-term mentality can help you make sound investments in Nigeria that yield consistent returns over time.

Seeking Unrealistic Returns

Investing in Nigeria can sound like a great idea, but it can also be incredibly risky if you’re not careful. One of the biggest mistakes you can make is expecting unrealistic returns—it’s amazing how quickly your money can add up if you’re playing it right, but it’s even more amazing how quickly it can disappear if you’re not!

It’s easy to get lost in the potential of big profits and high returns, but it’s important to remain realistic when investing in Nigeria. It takes time for investments to mature and yield results, so be sure to calculate your expected returns from the onset, rather than relying on speculative figures that could leave you disappointed.

Not Having a Good Knowledge of What Your Investment Company Invest In

One of the most common mistakes people make when investing in Nigeria is not having good knowledge of what their chosen investment company is investing in. While it’s important to trust the credentials of your firm, it’s also essential to be aware of what it’s investing in and how it works. After all, you’ll want to make sure that you’re entering into a deal that fits your risk profile and has potential for profit-making.

Luckily, it’s fairly simple to do your research before committing to an investment. Here are some points to consider:

- What types of investments does the company specialise in? Are these more risky or more conservative?

- Does the company have a sound financial strategy for managing its investments?

- Are there any hidden costs or risks associated with their investments that could lower your potential return on investment?

Taking the time to assess each potential investment opportunity carefully can help ensure that you maximise your profits—and avoid losing your money!

Diversifying Your Portfolio

A good rule of thumb is to diversify your portfolio – that way, you can enjoy the benefits of higher-return investments without taking too much risk.

Instead of putting all your eggs in one basket, why not invest in different markets? Though Nigeria has the potential for great returns on investment due to its large population and strong economic growth rate—diversifying will give you more reliable returns across different asset classes.

So if you want to be a successful investor in Nigeria—remember: diversification is key!

For example, if you invest in real estate, don’t just buy a handful; spread your investment across other sectors for maximum benefit.

Also, keep up with news sources and financial journals so that you know when there are any changes that might affect your investments. This will help ensure that your hard-earned money isn’t gone before you know it!

Not Utilising the Power of Compound Interest

You may not know this, but one of the reasons why people lose money investing in Nigeria is that they fail to utilise the power of compound interest. Compound interest ensures that your investments grow exponentially over time, and while you may see slow growth initially, the long-term results are truly remarkable.

Why Is Compound Interest So Powerful?

Compound interest is so powerful because it works on the principle of ‘interest on interest’. When you calculate compound interest, the calculations take into account how much your money has earned so far, and each year, that amount increases.

In summary, investing can be a great way to grow your money in Nigeria. Understanding the markets and learning about the risks is a great way to take control of your investments and make solid decisions that can help you reach your financial goals.

Investing is also an immense step towards achieving financial freedom, this is why Havvest offers you the right approach, adequate information and a safe haven to help you get started on your savings and investment journey. Create a Havvest account today and enjoy your interests and returns tomorrow!