Oftentimes, in the finesse of our solitude the thoughts that cloud our minds range from building wealth (sometimes in our fantasies) to losing hope because our fantasies don’t just miraculously come into fruition.

Firstly, let’s remind ourselves what wealth is:

Wealth is the abundance of valuable resources or valuable material possessions. This includes the resources of natural capital, such as land, forests, water, and minerals. It also includes the resources of human capital, such as education, skills, and health. And it includes the resources of financial capital, such as stocks, bonds, and savings.

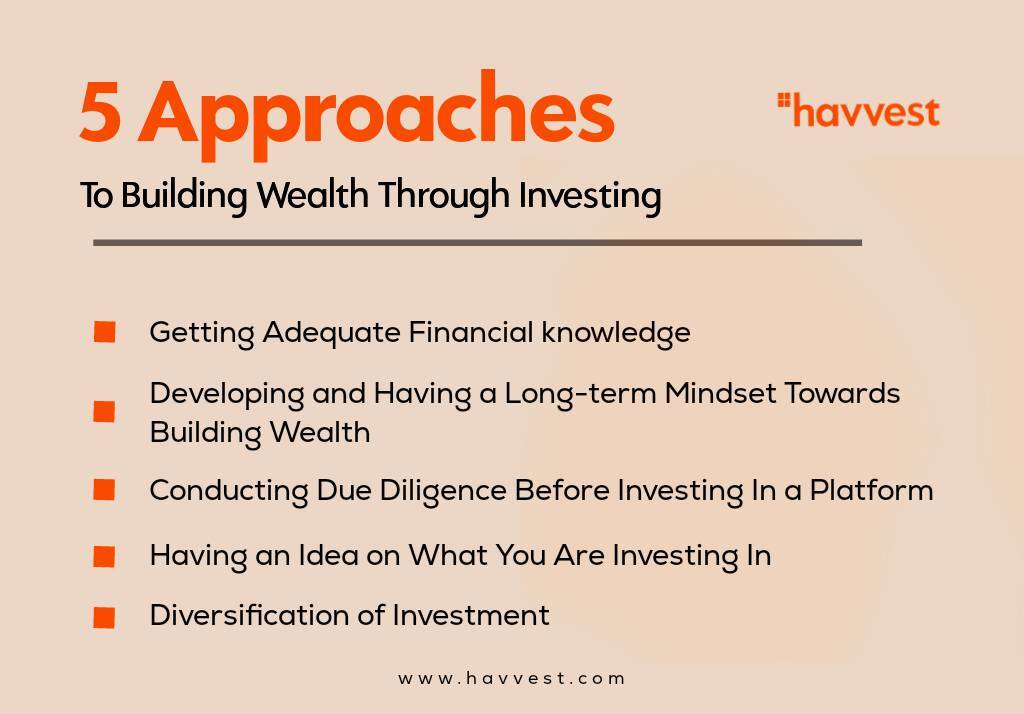

Contrary to what we see everywhere online and hear when we listen to overly motivated speeches; building wealth requires strategies and discipline. Therefore, we’ll be looking at approaches that will give you an edge when building wealth through investing.

- Getting Adequate Financial knowledge:

Take for instance you are sailing a ship and you’re met with a storm, in the midst of all the hassles the first thing you want to look at before navigating is your compass. This is because you want to make sure you are on the right course. The compass in this instance is adequate financial knowledge.

Like the compass, knowing about its existence is just one tip of the iceberg, understanding how it works eventually helps take you to your destination. Likewise financial knowledge, in its nescience it is useless simply because there’s a requisite amount of knowledge needed to adequately invest especially in a pertinent platform which ultimately help you building wealth long-term.

- Developing and Having a Long-term Mindset Towards Building Wealth

A mindset is simply a set of beliefs that we hold about ourselves and the world around us. Our mindset shapes how we see ourselves and the events that happen to us. It also affects our behaviour and how we react to challenges and setbacks.

Developing a good mindset towards wealth building simply means having our mindset deeply rooted in financial growth.

The ability to develop a long-term mindset is key to building wealth over time. By definition, wealth is the abundance of valuable resources or valuable material possessions. While it is possible to earn a large sum of money quickly, sustainable wealth accumulation requires a focus on long-term goals and a dedication to consistent saving and investing.

There are a few things you can do to develop a long-term mindset towards building wealth:

- Set clear financial goals: Without a clear goal in mind, it can be difficult to stay motivated to save and invest. Determine what you want to achieve financially and set a realistic timeline for reaching your goal.

- Stay disciplined: It can be tempting to spend money when you have it, but it’s important to stay disciplined if you want to build wealth. Automate your savings and investing so that. it acts as a reminder that you have to set aside funds for this.

- Conducting Due Diligence Before Investing In a Platform

Greed is a powerful emotion that can drive people to do things they wouldn’t normally do. And when it comes to financial scams, greed is often the driving force behind why people fall for them.

Scammers are very good at playing on people’s greed. They promise big returns with little or no risk. They use high-pressure tactics to get people to make snap decisions. And they prey on people who are already in a difficult financial situation.

If you’re not careful, greed can blind you to the risks involved in a financial scam. So it’s important to be aware of how scammers play on people’s emotions and to carefully consider any investment decision you make.

- Having an Idea on What You Are Investing In

Having a clear understanding on the company’s choice of investment is very important. This should be one of the basic knowledge acquired. Other important additional information include the type of investment you want to take part in, and the amount of projected return expected. This usually acts as a guide to telling how credible the investment platform is.

- Diversification of Investment

It is not advisable for a newbie to engage in this part of investing. Diversification is one of the most important aspects of investing. It is a risk management technique that allows you to spread your investment across different asset classes, could also extend to different industries as well as geographical regions.

This helps harness the potentialities in each sector while minimising risk that may be encountered through the course of investing.

There are many different ways to diversify your investment. One quick way is to invest in different types of property, such as residential, commercial, or industrial real estate.

Diversification is a key part of any successful investment strategy.

Since we are a company with a plus, we’ll be adding a bonus method.

- Tapping Into the Power of Compound Interest

Compound interest is one of the most powerful forces in the universe – and it can also be one of the most powerful tools in your financial arsenal. By definition, compound interest is interest that is earned not only on the original principal, but also on the accumulated interest of previous periods. In other words, it’s interest on interest.

While the concept of compounding may seem complex, the basic idea is actually quite simple. And by leveraging the power of compound interest, you can potentially amass a fortune over time.

There are two key elements to compounding: time and compound interest rate. The longer the time frame, the more time compound interest has to work its magic. And the higher the compound interest rate, the greater the exponential growth.

There are several different ways to approach building wealth through investing. However, the most important thing is to start early and invest consistently. This will allow you to take advantage of compound interest and build your wealth over time.

At Havvest, we help you get started with saving and investing through compounding. We also provide you with the requisite knowledge needed to go through the journey. Save and invest today with Havvest and experience the magic of compound interest.Â

1 Comment