In finance, complex terminologies can often create barriers for individuals seeking to understand and navigate the intricacies of money management. In this blog post, we will delve into the importance of understanding these financial buzzwords and shed light on the potential risks of misinterpreting them.

What are Financial Buzzwords?

Financial buzzwords refer to specialised terminology used within the finance industry. These can also be trendy or popular terms, phrases, or jargon used in the financial industry that capture attention and gain widespread usage over a period of time. However, for non-technical audiences, deciphering these buzzwords can be daunting, hindering their understanding of critical financial matters.

Deciphering These Buzzwords

Understanding financial jargon requires a systematic approach that breaks down complex terms into more digestible components.

Here are some strategies to help decode financial terminology:

- Breaking Down Words: Dissecting a term into its constituent parts, such as prefixes, roots, and suffixes, can provide clues to its meaning. By recognising familiar elements within unfamiliar words, you can unravel their significance and relate them to your existing knowledge.

- Creating Acronyms: Transforming complex terms into memorable acronyms can aid in retention and recall. By associating an acronym with a specific meaning, you can break down a term into more manageable mental chunks, making it easier to understand and remember.

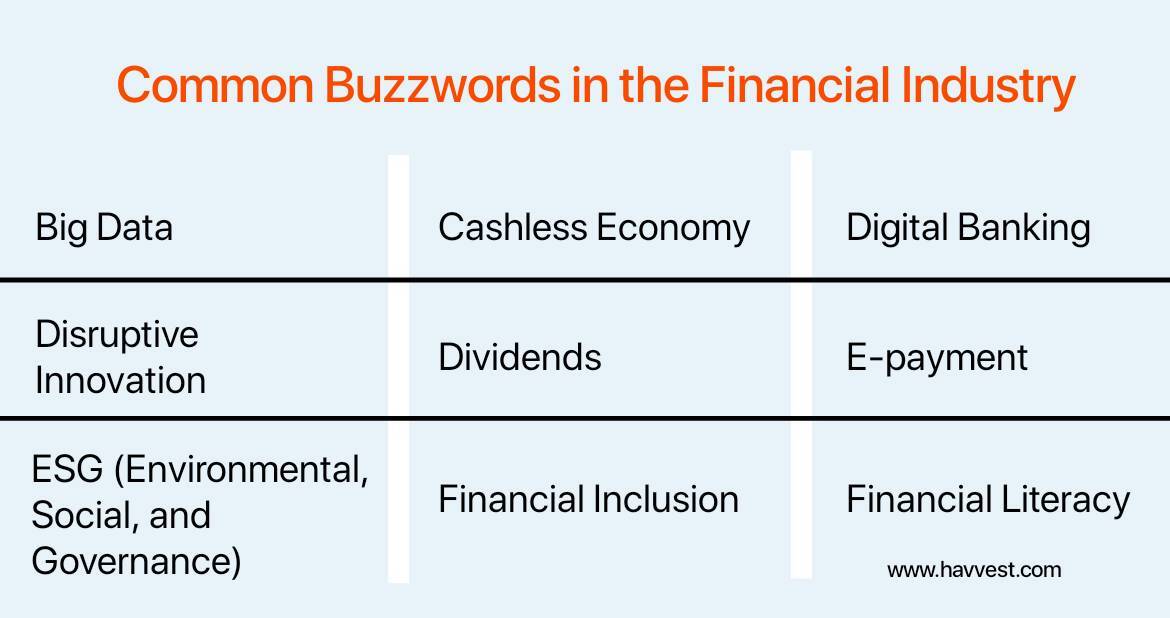

Common Buzzwords in the Financial Industry

Active investing: This refers to an investment strategy where an investor actively selects and manages individual securities or assets in an attempt to outperform the overall market or a specific benchmark.

Assets: Assets refer to any resource or property that holds economic value, such as cash, real estate, stocks, bonds, or intellectual property, which can generate future benefits or be converted into cash.

Big Data: Refers to the vast amount of structured and unstructured data generated from various sources that can be analysed for insights and decision-making in finance.

Bonds: Governments or corporations issue bonds to raise capital, and investors lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

Cashless Economy: The push towards reducing cash transactions and promoting electronic payment methods in Nigeria.

Compound Interest: Compound interest is the concept of earning interest not only on the initial investment but also on the accumulated interest over time, resulting in an exponential growth of the investment.

Digital Banking: The shift towards online and mobile banking services, enabling customers to conduct financial transactions digitally.

Disruptive Innovation: The introduction of new technologies or business models that significantly alter existing markets, often challenging traditional financial institutions and practices.

Dividends: This is the distribution of a portion of a company’s earnings to its shareholders, usually in the form of cash or additional shares of stock.

Diversification: Spreading investments across various assets to reduce risk.

E-payment: Electronic payment methods, including mobile money transfers, online banking, and card payments, gaining popularity in Nigeria.

ESG (Environmental, Social, and Governance): A set of criteria used to assess the sustainability and ethical impact of a company’s operations for responsible investing.

ETF (Exchange-Traded Fund): An ETF is a type of investment fund that trades on stock exchanges, comprising a basket of securities and designed to track the performance of a specific index, sector, or asset class.

Financial Inclusion: The efforts to ensure access to financial services and products for underserved populations in Nigeria, particularly in rural areas.

Financial Literacy: Promoting knowledge and understanding of financial concepts and skills among Nigerians to make informed financial decisions.

Fintech: Short for financial technology, it encompasses innovative technologies and software applications that aim to improve financial services and processes.

Gig Economy: Refers to a labour market characterised by the prevalence of short-term contracts or freelance work, often facilitated by digital platforms and mobile apps.

Investment: Investment refers to the allocation of money, time, or resources into assets or ventures with the expectation of generating income, growth, or appreciation over a certain period.

Liquidity: This refers to the ease and speed at which an asset, such as cash or a financial instrument, can be bought or sold in the market without causing significant price changes.

Microfinance: Financial services, such as small loans and savings accounts, are provided to individuals and small businesses with limited access to traditional banking.

Naira Devaluation: The reduction in the value of the Nigerian Naira currency compared to other foreign currencies, often a topic of concern in the country’s financial landscape.

Quantitative Easing: This is a monetary policy tool used by central banks to inject money into the economy by purchasing financial assets.

Passive Investing: Investment strategies that seek to replicate the performance of a market index rather than actively picking individual assets.

Portfolio: A portfolio is a collection of investments, such as stocks, bonds, and other assets, held by an individual or entity to achieve financial objectives and manage risk.

Savings: Saving is the act of setting aside a portion of income or resources for future use or to meet specific financial goals.

Stocks: Stocks represent ownership shares in a company, giving investors a claim on its assets and earnings as well as the potential for capital appreciation.

A clear understanding of these buzzwords is essential for effective financial decision-making and risk management. This way, you get to understand them as well as use them effectively.

We hope this blog post has provided valuable insights into common financial buzzwords used in daily interactions in the financial industry. Stay connected with us by subscribing to our unique email list, where we treat you like the VIP you are.

To get updates, stay tuned as we regularly share informative articles, practical tips, and expert advice on various financial topics to help you achieve your financial goals. We remain your ultimate partner in the world of savings, investments and smart money management.