Saving and investing in your future can be a little tricky. This is because you may be oblivious to how to get started. Don’t worry though, we will guide you to getting the best of your financial journey.

Havvest is a company created to impact the lives of people in great ways. Havvest is focused on providing financial services or products through technology, such as mobile apps or online platforms. These services include a platform where you get to save and invest with Havvest.

At Havvest, two major things happen; Savings and Investing.

In the sections below, we’ll show you how saving and investing with Havvest is so easy that you can do it while you’re asleep — to stretch this slightly.

Saving for the Future

Saving money is an essential aspect of financial planning, and it is crucial to consider both short-term and long-term goals. Whenever we save, we construct a financial cushion that will provide us with financial stability and peace of mind.

One way to save effectively is to plan ahead for miscellaneous expenses. These can include birthdays, the birth of a child, rent, school fees, holidays, and weddings. As Nigerians, we are already ladened with stress from different sectors, and the best way to avoid additional financial stress is through saving.

Another important factor to consider when saving is interest rates. At Havvest, we hold our clients highly estimably and this reflects in our interest rates. Depending on the length of your saving period, different interest rates may apply. For example, a one-year savings term offers a 15% interest rate, while a three-month term offers only a 3% interest rate. Taking advantage of our high-interest rates will help you earn more money as well as solve your financial issues faster over time.

All things considered, saving for the future necessitates thorough preparation and attention to detail. Therefore, you can create a strong financial foundation and safeguard your financial future by planning ahead.

How to get started with investing

The most basic thing about investing is that it requires capital and involves a long-term commitment. This includes research, analysing market trends, and evaluating the potential return on investment.

What are the perks of adopting an investment plan

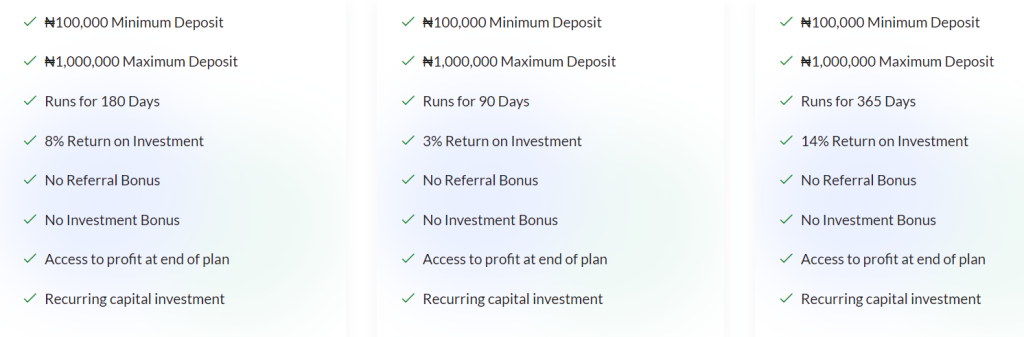

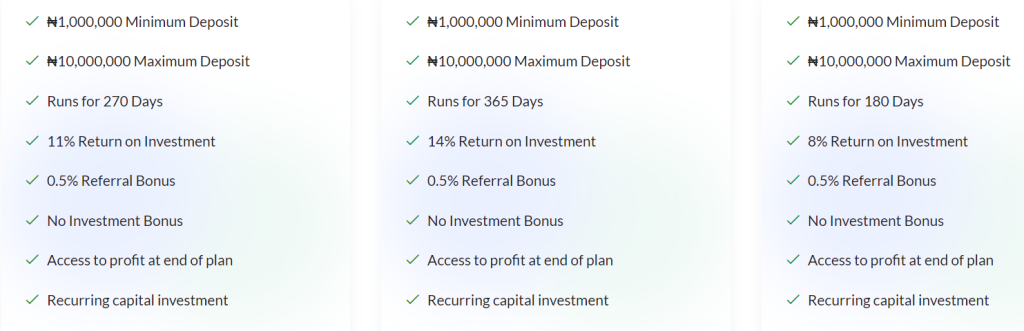

Basic plan:

- The basic plan is suitable for anyone who is new to investing and wants to start with a small investment amount. It allows investors to test the waters of investing without risking too much of their money.

- It offers immediate returns as it spans for a shorter period of time, which means that investors can see the results of their investments sooner.

- This plan is easy to understand, and investors can learn the basics of investing through this plan.

Standard plan:

- The standard plan is suitable for individuals who have some experience in investing and are comfortable with investing for a longer period of time.

- This plan covers a longer period of time, which allows investors to maximise their earnings through compound interest and returns on investment.

- The standard plan offers a higher return on investment compared to the basic plan, as it involves a longer investment period.

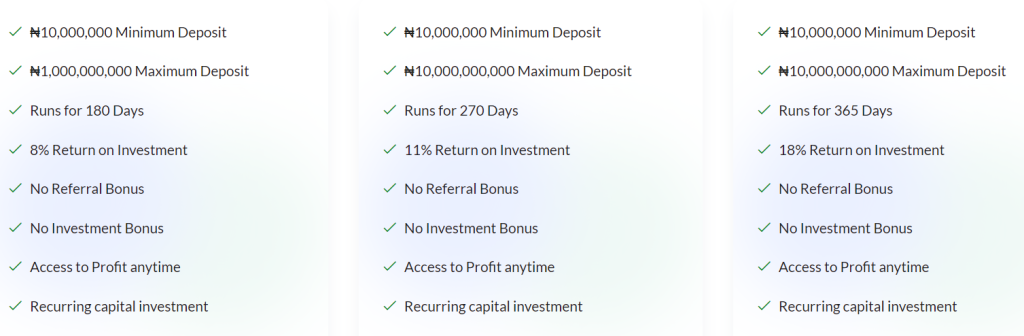

Professional plan:

- The professional plan is suitable for experienced investors who understand the benefits and value of investing.

- It offers expert counselling on the best professional program that suits individual needs, which helps investors to make informed decisions.

- The major perk of being a professional investor is that you get to enjoy the highest ROI, as you have the opportunity to invest in a wide range of high-return investments.

- Professional investors can customise their investment plan according to their specific investment goals and risk tolerance.

- Professional investors have unlimited access to their returns, which means that you can withdraw their funds anytime you need to. This flexibility is particularly useful for investors who require their investment returns to meet their financial goals or emergency needs.

Now that you have all this information in the palms of your hands, what are your plans with it?

“Most people miss Opportunities because they are dressed in overalls and look like work.”

Thomas A. Edison

Havvest has structured its plans in a way that eliminates the need for work, leaving us with opportunities and you to take them. Register with us right away to take this giant step toward actualising your financial goals.

2 Comments