You are currently at the main entrance of the banking hall, wondering how you got into this mess. The staircase leading to the manager’s office is so familiar, you could go there blindfolded; but that was the least of your worries.

You remember the day you opened your bank account. You had been so happy, confident that since it was a savings account, the money accrued would make for something substantial… phew! the biggest crap ever heard.

The realisation soon began to sink in as you paced through the hallways. Your mistakes started to reveal themselves one by one. You hadn’t saved smartly, instead opting for riskier investments that yielded losses instead of profits.

Well, we’ve all been here at different points in our lives, although for some people, it wasn’t quite as bad. As they say, “An ounce of prevention is worth a pound of cure”, so let’s look at why situations like this occur and how to nip it in the bud.

Setting Your Financial Goals

As the aforementioned example demonstrates, a series of poor choices were made, starting with the incorrect savings vehicle chosen and ending with a flawed and poorly constructed investment plan.

When we discuss financial goals, we should ideally be talking about particular objectives or aims that both people and businesses want to attain. This might appear as financial positions, earnings, expenses, or investments.

These goals can be long-term or short-term and may include objectives like debt payment, a down payment for your home or car, a commitment for a business, or something saved up for your retirement.

Setting financial goals are very important for several reasons:

- It provides people with a sense of direction and purpose. It points to the bigger picture of specific goals to work towards.

- It helps people prioritise their spending and saving habits. This helps them create a budget that aligns with their goals.

- Measuring your progress becomes feasible, making it easier to adjust strategies or make changes where necessary.

- It helps build financial security. This is very underrated, as some age groups sometimes don’t see the need to be informed and prepared for the future.

These factors, highlighted in the importance of setting financial goals, may help you make the right choice when selecting a smart savings platform.

Investing in High Yield Platforms

High-yielding savings platforms are financial institutions or products that offer higher interest rates compared to traditional savings accounts. These platforms provide an opportunity for individuals to earn a higher interest on their savings while still keeping their money safe and easily accessible.

A prime example of one of these institutions is Havvest. It is a fantastic smart savings platform that offers you the opportunity to build wealth and achieve financial freedom by enabling you to save responsibly for any occasion, such as a birthday celebration, an anniversary, a trip, the birth of a child, or the holiday season.

This is achieved when a savings account is created with us. This account can then be credited in instalments or in one lump sum.

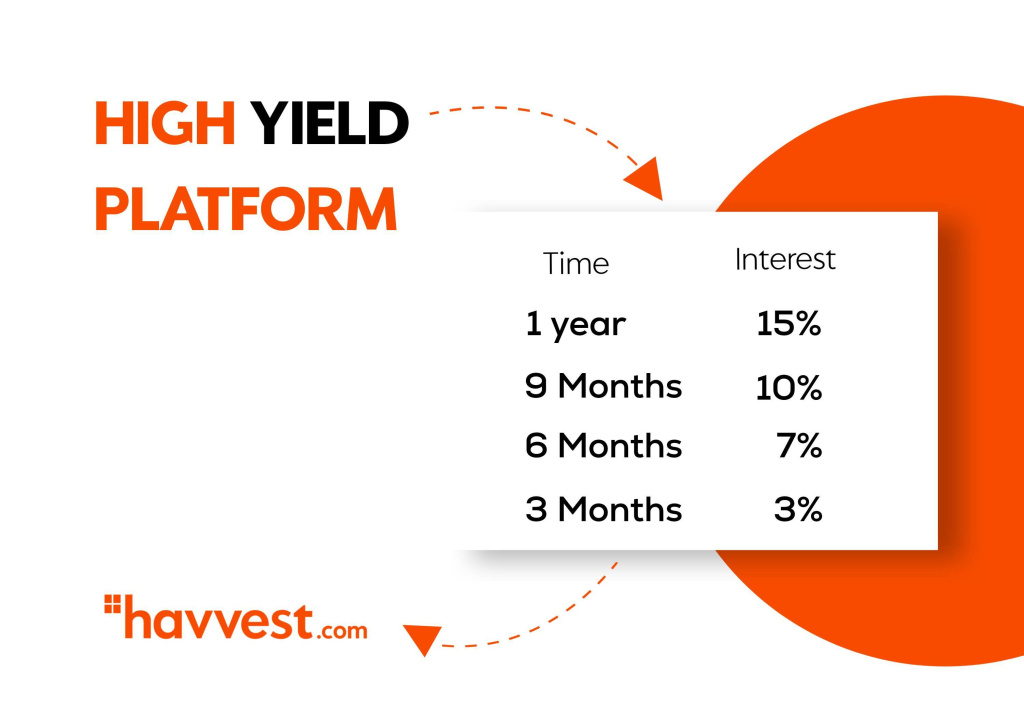

Now to the part you’ve been waiting for! Havvest offers one of the best interest rates in the market. The option of automated savings is also available. This was thoughtfully developed to support the saving culture. In essence, all you have to do is relax while making on-the-go savings.

| Time | Interest accumulated(%) |

| 1 Year | 15% |

| 9 Months | 10% |

| 6 Months | 6% |

| 3 Months | 3% |

You wouldn’t want to sleep on this opportunity; you snooze, you lose! Click here to get started.

Budgeting Strategies For Saving Money and Growing Wealth

Budgeting is a powerful technique for saving money and achieving financial independence, just in case you’re asking, “how can I save money?” Budgeting is the answer.

The absence of budgeting was primarily one of the obvious problems of the individual in the illustration above.

When we don’t make plans, significant things that can change our trajectory occur. On occasion, it seems as though every decision made at that time may take a downhill surge. Nevertheless, this shouldn’t be overwhelming for you, as there is a remedy.

According to psychologist Edwin Locke, setting specific, measurable, realistic, relevant, and time-bound goals can help you save more money fast. Therefore, creating a budget can help you achieve this goal while still prioritising your needs. Even if you’re a fixed salary earner, this is how to save money from salary – budgeting.

Next in line is distinguishing between long-term saving goals and short-term saving goals. Short-term saving goals may range from things like purchasing a piece of furniture or paying for a dinner date. A long-term saving goal on the other hand could be a combination of short-term goals or even span as large as saving to start a business.

Another excellent smart saving strategy is keeping track of your expenditure. It involves having a clear understanding of how much money is coming in, how much you need to spend, and how much you can potentially save.

One of the simplest jobs to perform should be saving money, and this can be achieved regardless of your financial situation. You just need a bit of discipline and forethought.

What Should Be Your Next Line of Action?

Just in case you’re wondering where to go from here in terms of saving for the future or for your important needs, here’s what to do. We have created Havvest with the smart saver like you in mind.

We don’t just want you to save every month, but we have created a strategic way of letting you save on autopilot every single month – Automated savings. To see for yourself how simple it is to save automatically, simply sign up for a Havvest account.

Set it up once, and the Havvest system will do the rest of the work for you. Savings shouldn’t be a burden, but a fun goal to achieve.

You should understand that we don’t just want you to save money because of its financial value; we want you to save smartly because we want you to be financially secure. Register at Havvest now! The smart savings platform.

1 Comment